Key Takeaways

- Digital assets are property: Most tax authorities, including the U.S. IRS, treat cryptocurrencies like property (similar to stocks). Gains are taxed, and losses may offset other gains.

- Gains vs. income: Profits from selling or trading crypto are capital gains. Receiving crypto (mining, staking, salary, airdrops) is ordinary income at the coin’s fair-market value when received.

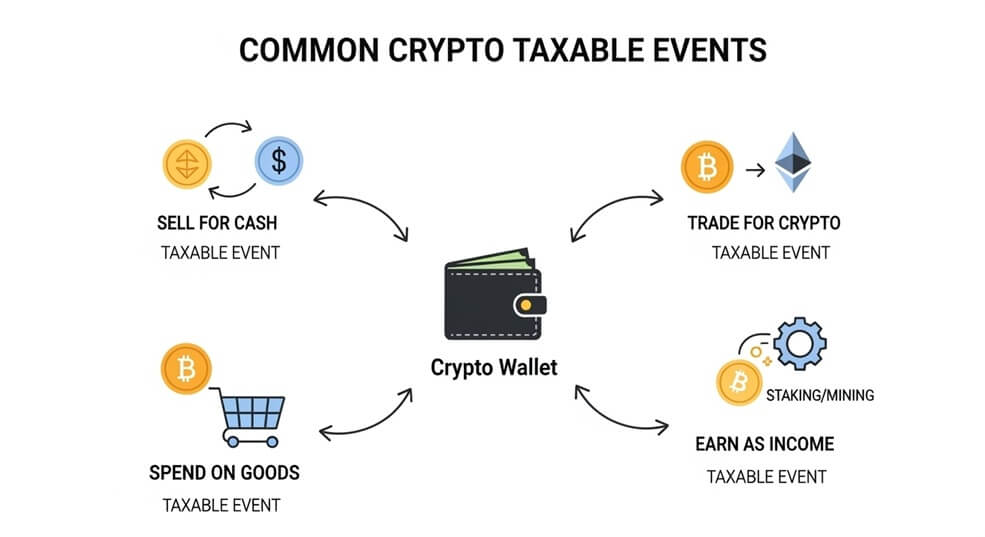

- Taxable events happen often: Selling for cash, swapping one coin for another, paying for goods with crypto, or earning rewards can all be taxable—even if you never touch traditional money.

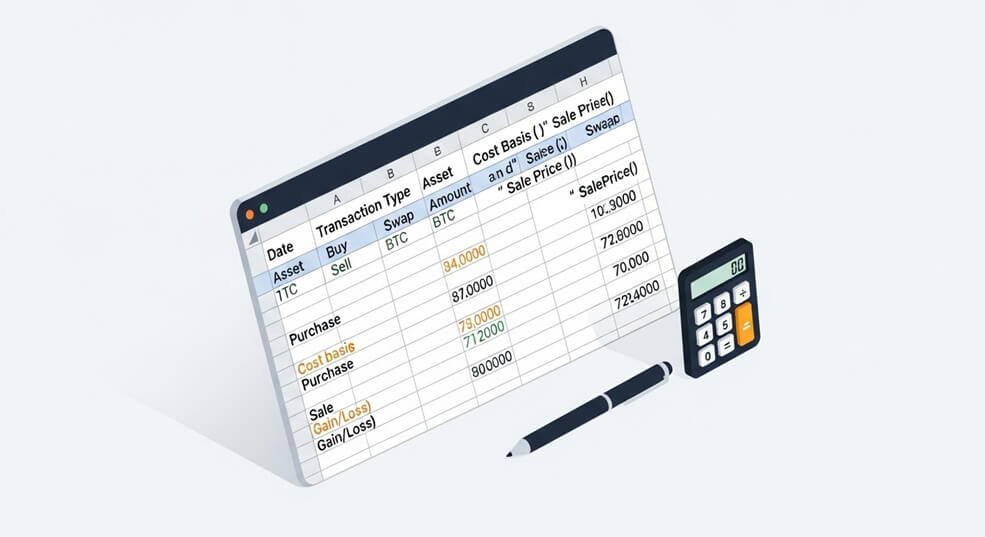

- Record-keeping is critical: Track every acquisition and disposal (dates, values, fees). Good records make it easier to complete forms like IRS Form 8949 and Schedule D.

- Regulations evolve: Crypto-tax rules can change quickly. Check official guidance and consult a tax professional for your personal situation.

How Digital Assets Are Treated for Tax

In most jurisdictions, digital assets are taxed as property, not currency. Think of crypto like a collectible baseball card: if you bought a card for $100 and later sold it for $150, your $50 profit is a taxable capital gain. If you hold the asset longer than a year, many countries apply lower long-term capital-gains rates; selling sooner often means higher, short-term rates.

Crypto earned through work, staking, or mining is treated like wages. Its fair-market value when you receive it counts as ordinary income— similar to getting paid in company stock instead of dollars.

Taxable Events and Reporting Requirements

Buying and Selling

Buying crypto with fiat currency generally is not taxable at the moment of purchase—it simply sets your “cost basis.” Selling crypto for fiat is taxable: gain = sale price − cost basis.

Trading Crypto for Crypto

Swapping one coin for another is treated as if you sold the first coin for its dollar value and bought the second. Any gain or loss on the coin you disposed of must be reported.

Using Crypto to Buy Goods or Services

Spending crypto is the same as selling it. Example: If you bought 1 BTC for $5 000 and later used it to buy a laptop when BTC is $50 000, you owe capital-gains tax on the $45 000 profit.

Mining, Staking, and Earned Crypto

Rewards from mining or staking are ordinary income at the coin’s value when credited to you. Those coins then have their own cost basis for future gains or losses when you sell them later.

Airdrops and Hard Forks

New coins received from an airdrop or blockchain fork are also ordinary income when they show up in your wallet. Their dollar value on that date becomes both taxable income and your cost basis.

Gifts and Donations

Giving crypto as a gift is generally not taxable to the giver (though very large gifts may require a gift-tax filing). The recipient inherits the giver’s cost basis. Donating crypto to a qualified charity can yield a deduction similar to donating appreciated stock, provided you follow appraisal and documentation rules.

Record-Keeping and Tools

Good records are your tax safety net. For every transaction, log:

- Date and time

- Amount of crypto

- Fair-market value in local currency

- Transaction fees

- Wallet or exchange used

Common accounting methods include FIFO (first in, first out) and specific-identification. Choose a method and stick to it consistently. Exchanges often let you download CSV files, and crypto-tax software can import data and populate IRS Form 8949, Schedule D, or local equivalents.

Key U.S. forms: capital gains → Form 8949 + Schedule D; self-employment income → Schedule C; gifts → Form 709. Other countries have their own schedules—check local requirements.

Risks & Important Considerations

- Educational only: This content is not tax advice. Consult a qualified professional.

- Mandatory reporting: Tax agencies increasingly require exchanges to share user data. Failing to report can lead to fines, interest, and audits.

- Complex and evolving: Rules differ by country and can change yearly. Stay updated and verify guidance for your jurisdiction.

- Record burden: Frequent trades or DeFi activity may generate hundreds of reportable events. Poor records can mean over- or under-paying taxes.

- No planning advice: This module explains obligations; it does not recommend strategies to reduce tax.

The following links are provided for educational and informational purposes only. Literacy & Innovation in Financial Technology Alliance (LIFT) does not endorse any of the organizations, products, services, or opinions presented on these external sites. LIFT is not responsible for the accuracy or content of external sites. We encourage you to conduct your own research.

Further Reading & Sources

- IRS – Digital Assets

- Investopedia – Cryptocurrency Taxes

- Coinbase – Understanding Crypto Taxes

- Koinly – U.S. Crypto Tax Guide

- PwC – Digital Assets Tax Guide

- Fidelity – How Is Crypto Taxed?

Disclaimer: This article is provided for educational purposes only and does not constitute accounting, legal, or financial advice.