Key Takeaways

- Blockchains are shared ledgers: Think of a blockchain as a public notebook that many computers keep identical copies of. Everyone sees the same history of transactions, which builds trust without a central authority.

- Design choices create trade-offs: Bitcoin focuses on being “digital gold,” while Ethereum acts as a programmable world computer. Each chain optimizes for different goals, so no single blockchain is best at everything.

- Speed vs. decentralization: Newer chains like Solana aim for very high transaction speeds and low fees, but they often rely on smaller validator sets. Older chains such as Bitcoin and Ethereum sacrifice speed to maximize openness and security.

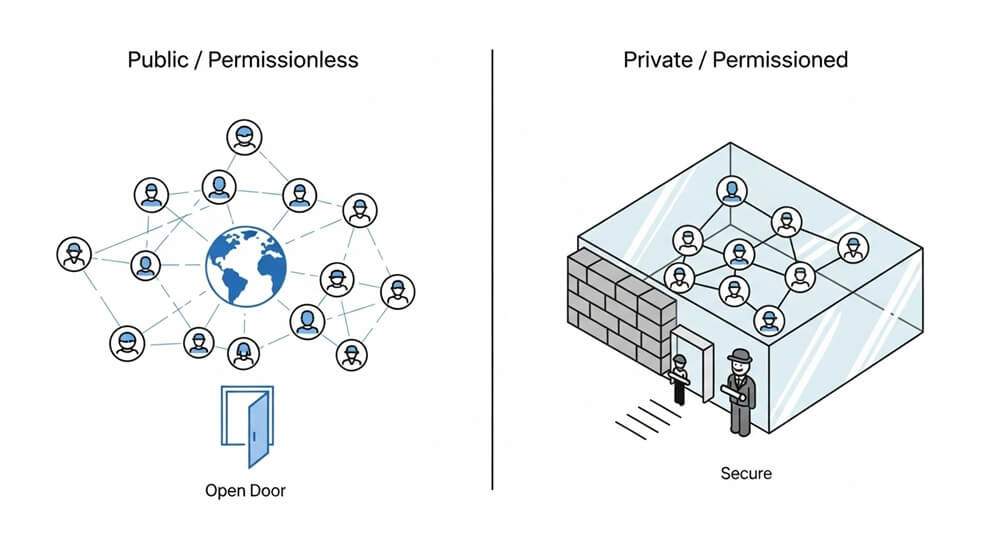

- Public vs. private networks: Public blockchains are open to anyone, while private (permissioned) blockchains restrict access to known participants. Each model suits different use cases.

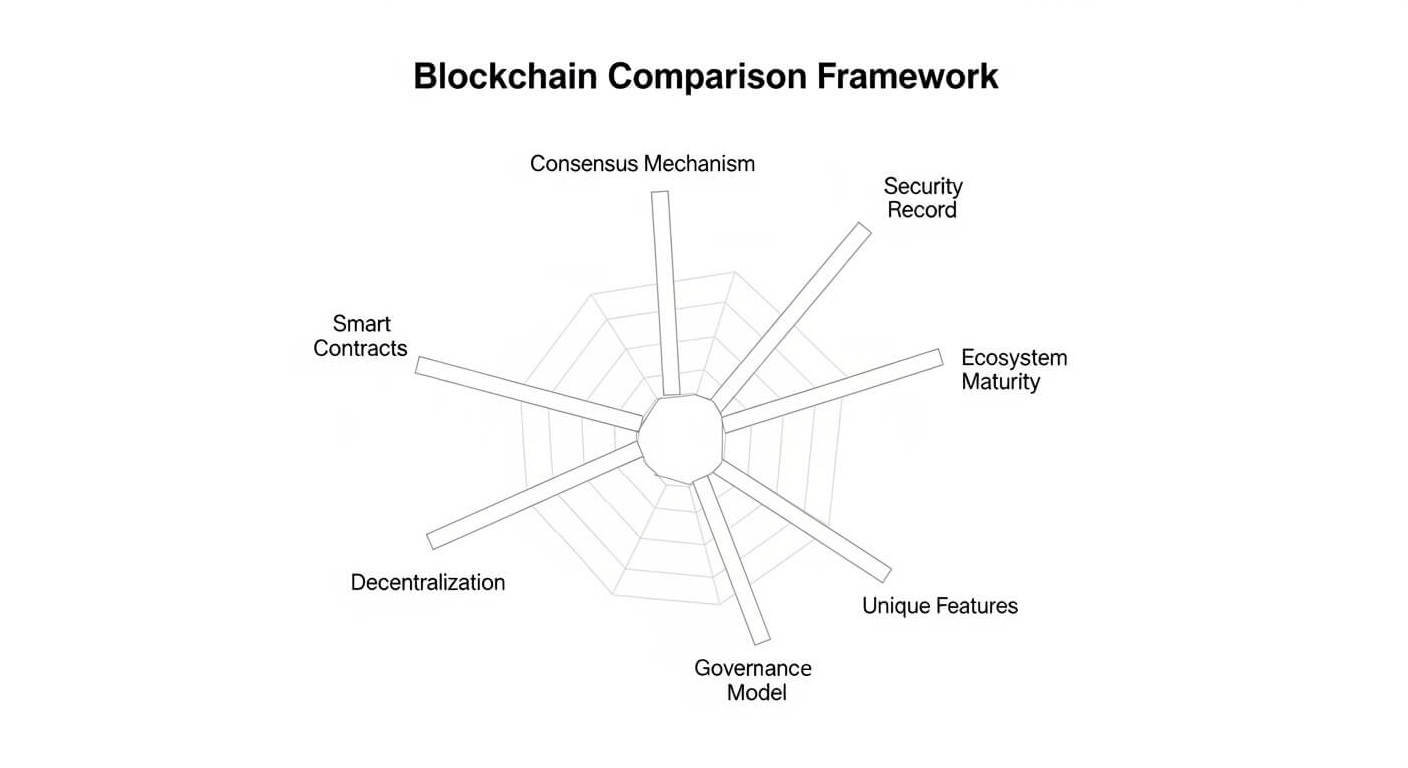

- Framework for comparison: When you hear about a new blockchain, ask about its consensus method, throughput, fees, decentralization level, governance model, and real- world track record.

Case Study 1 — Bitcoin vs. Ethereum: Different Aims, Different Tech

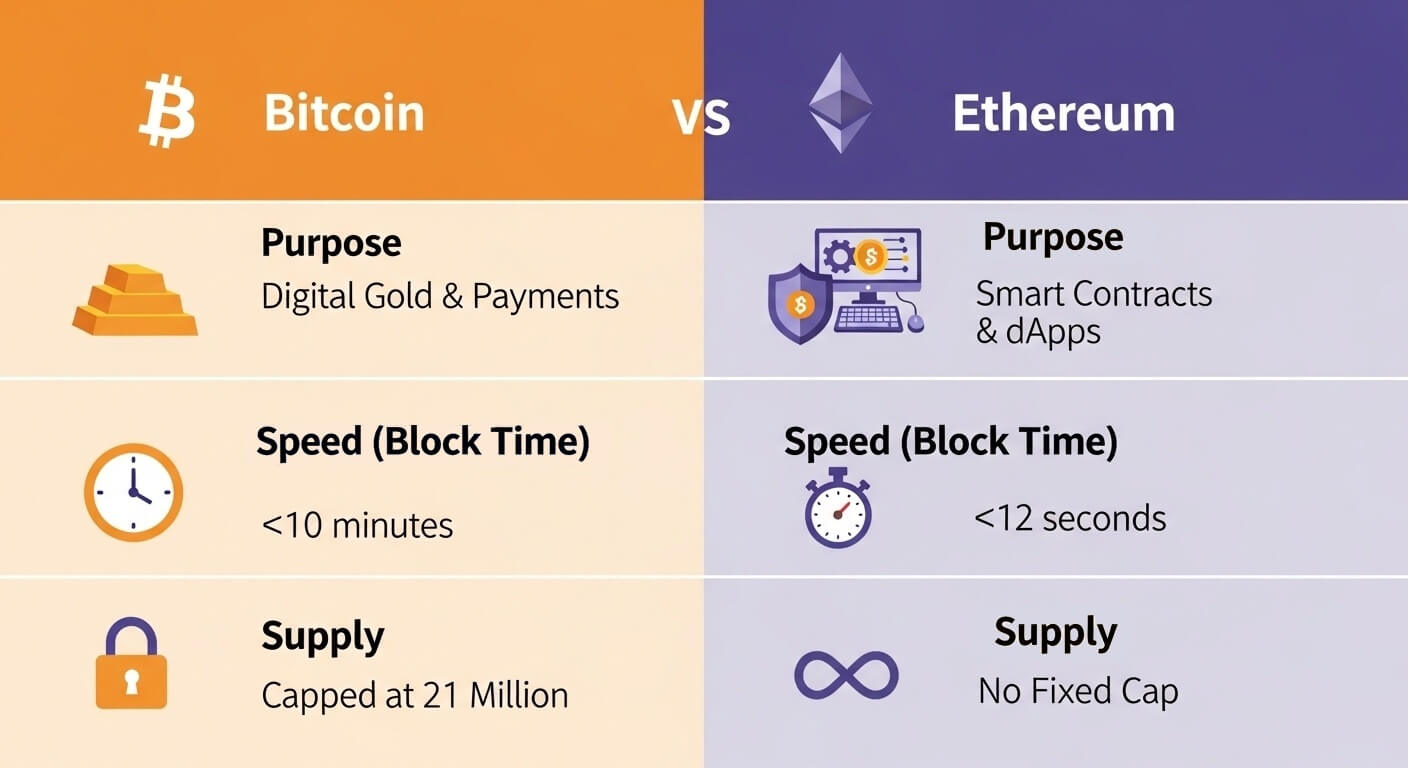

Purpose: Bitcoin was created to be an independent form of money and long-term store of value. Ethereum was designed as a platform for running smart contracts and decentralized applications (dApps).

Consensus & security: Bitcoin relies on Proof-of-Work mining, which is energy-intensive and produces a new block roughly every ten minutes. Ethereum now uses Proof-of-Stake, where validators lock up (stake) ETH and create new blocks about every twelve seconds. PoS is far more energy-efficient but involves different security assumptions.

Supply & economics: Bitcoin has a hard cap of 21 million coins, making its supply predictable and scarce. Ether (ETH) does not have a fixed cap; instead, Ethereum introduced fee “burning” that can reduce supply when network activity is high. Each policy reflects its community’s philosophy.

Transaction capability: Bitcoin’s base layer mainly handles simple BTC transfers. Ethereum’s base layer executes many kinds of transactions (smart-contract calls) but charges gas fees that rise when the network is busy.

Bottom line: Bitcoin excels at simplicity and scarcity; Ethereum excels at flexibility and programmability. Each made deliberate choices that suit different goals.

Case Study 2 — Alternative Ecosystems

Ethereum vs. Solana

Solana targets very high throughput (tens of thousands of transactions per second) using a hybrid Proof-of-History + Proof-of-Stake approach. This speed supports fast games and real-time trading, but it requires powerful hardware and has resulted in several temporary outages. Ethereum remains slower but more decentralized and battle-tested, with a much larger developer community.

Public vs. Private (Permissioned) Blockchains

Public networks (e.g., Bitcoin, Ethereum) allow anyone to read data and help secure the chain. Private or consortium chains (e.g., Hyperledger Fabric, Quorum) restrict participation to known entities, trading some decentralization for higher speed, privacy, and regulatory compliance— useful for business supply chains or inter-bank settlement.

Takeaway: Different problems call for different blockchain designs. Speed, privacy, and openness exist on a sliding scale.

Framework for Comparing Any Blockchain

- Consensus mechanism: PoW, PoS, or something else? Affects energy use, security assumptions, and openness.

- Transaction throughput & fees: How many transactions per second and at what cost?

- Smart-contract support: Can it run complex code or only simple transfers?

- Ecosystem maturity: Size of developer community, number of users, and availability of tools.

- Security track record: Years in operation, history of hacks or critical failures.

- Decentralization metrics: Number and geographic spread of validators or miners.

- Governance model: Community-driven or foundation-led? How are upgrades decided?

- Unique features: Privacy layers, interoperability, on-chain identity, etc.

Risks & Important Considerations

- Irreversibility: Mistakes and hacks on blockchains are usually permanent; there is no “undo” button.

- Security vulnerabilities: Smart contracts and cross-chain bridges can contain bugs that attackers exploit.

- Trade-offs are inevitable: Faster, cheaper networks may be less decentralized or more prone to outages.

- Ecosystems evolve: Upgrades can change performance and economics over time—always check the latest information.

- No endorsements: Examples here are academic. We do not recommend using or investing in any specific blockchain.

The following links are provided for educational and informational purposes only. Literacy & Innovation in Financial Technology Alliance (LIFT) does not endorse any of the organizations, products, services, or opinions presented on these external sites. LIFT is not responsible for the accuracy or content of external sites. We encourage you to conduct your own research.

Further Reading & Sources

Disclaimer: This article is for educational purposes only and does not constitute financial advice.