Key Takeaways

- Peer-to-peer finance on blockchain: Decentralized finance (DeFi) is a collection of blockchain-based financial services that let people trade, lend, borrow, and save directly with each other using cryptocurrency and smart contracts – no banks or brokers needed.

- Open access, no gatekeepers: DeFi platforms are open to anyone with an Internet connection and a crypto wallet. There are typically no centralized authorities deciding who can participate, enabling global 24/7 access to financial tools for users who might not have traditional bank accounts.

- Main building blocks of DeFi: Key components include decentralized exchanges (DEXs) for token trading, lending and borrowing protocols, stablecoins (crypto tokens pegged to stable assets like the US dollar), yield-farming strategies to earn rewards, and even decentralized versions of derivatives and insurance services.

- New opportunities & new risks: DeFi offers innovative ways to grow and manage money (like earning interest on crypto holdings), but it is experimental and comes with high risks. Software bugs, hacks, volatile asset prices, and lack of regulation can lead to sudden losses – so users must exercise caution.

What Is Decentralized Finance (DeFi)?

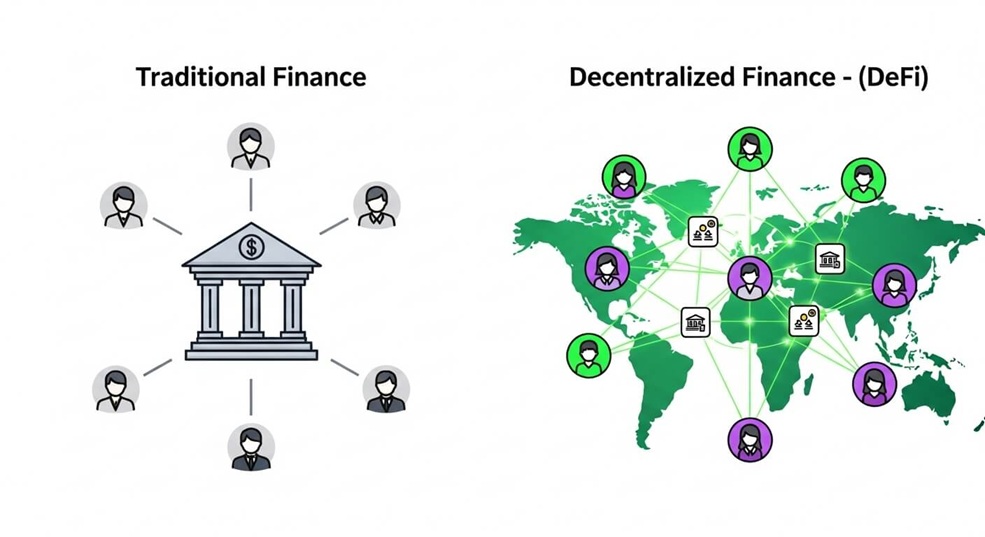

Decentralized finance, or DeFi, refers to financial applications built on public blockchains that enable people to engage in banking and investing activities directly with each other instead of through traditional intermediaries. In DeFi, transactions like sending money, lending, or trading are handled by smart contracts (self-executing programs on a blockchain) rather than by banks or payment processors.

DeFi is designed for open access. Anyone with an internet connection and a compatible crypto wallet can use DeFi services. There’s usually no lengthy signup process, no ID checks by a central authority, and no one who can arbitrarily freeze your account. This openness means DeFi can potentially offer financial services to people who don’t have access to traditional banks, anywhere in the world.

DeFi also achieves disintermediation – a big word for “removing the middleman.” Instead of trusting a bank or broker to honor an agreement, users trust the underlying code. For example, if you take out a loan in DeFi, a smart contract enforces the terms (like collateral and repayment) automatically. By cutting out intermediaries, transactions can be faster and fees can be lower, since there isn’t a company taking a cut at each step.

Analogy: Imagine DeFi as a giant global marketplace or swap meet for money. In traditional finance, you might go through a bank or broker (like shopping at a big retail store with a cashier) to exchange assets or get a loan. In DeFi, it’s more like a farmers’ market – everyone can set up a stall. People trade or lend directly with one another under agreed rules, and those rules are baked into the marketplace’s system (the smart contract code). There’s no single boss or gatekeeper overseeing transactions, just like a self-regulating vending machine for financial services.

DeFi Building Blocks

DeFi recreates many traditional financial services in a decentralized way. Here are some core building blocks of the DeFi ecosystem and what they do:

Decentralized Exchanges (DEXs)

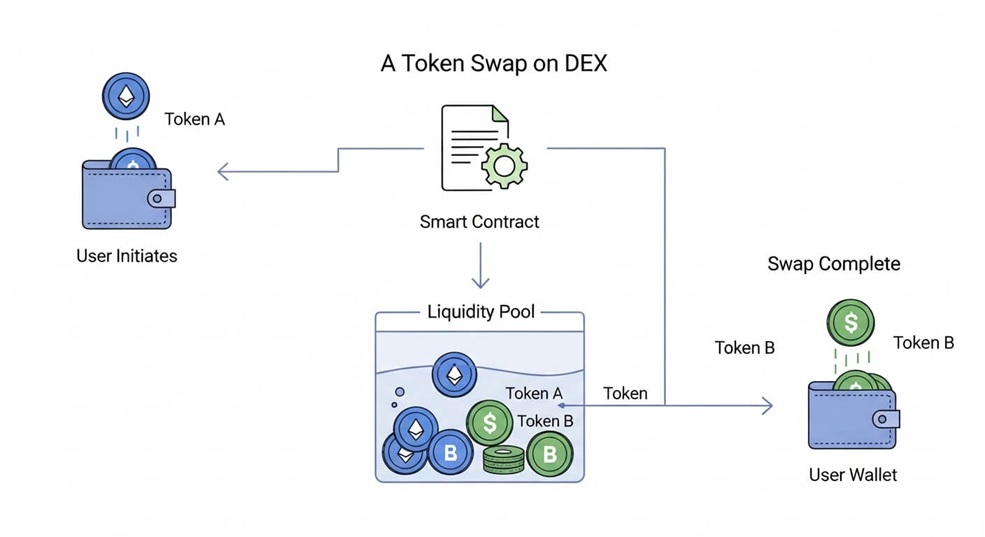

Decentralized exchanges are online platforms that let users swap one cryptocurrency for another without relying on a centralized exchange or broker. Instead of depositing funds into a company’s exchange, you trade directly from your crypto wallet. Trades on a DEX are powered by smart contracts that automatically match buyers and sellers (or buyers and a pool of funds) and execute the exchange of tokens.

Many DEXs use liquidity pools – think of these as big shared pots of tokens supplied by users. For example, one pool might contain Token A and Token B. When you want to swap Token A for Token B, the smart contract pulls Token B from the pool and adds your Token A to it (adjusting the price based on the pool’s formula). Because trades occur against pooled assets, there’s no need for a specific counterparty at that exact moment – the liquidity pool and contract facilitate the swap.

Analogy: A DEX is like a self-service currency-exchange kiosk or vending machine for tokens. You insert one type of coin and the machine (the smart contract) automatically gives you the equivalent value in another coin from the pool, according to the current rate. There’s no human teller involved. For instance, Uniswap, a popular DEX on Ethereum, allows users to trade tokens straight from their wallets by interacting with its automated “vending-machine” smart contracts.

Lending & Borrowing

DeFi offers platforms for lending and borrowing cryptocurrency in a peer-to-peer fashion. On these platforms, users who have extra crypto can lend it out to earn interest, and users who need crypto can borrow it, usually by providing collateral. Collateral is something of value you lock up to secure a loan (for example, depositing \$150 worth of one token to borrow \$100 of another). Smart contracts match lenders to borrowers and enforce the loan terms, automatically handling interest calculations and collateral.

This system is somewhat like a global, automated credit union or pawn shop. You don’t need a credit score or a bank manager’s approval – if you have the required collateral, you can borrow, and if you have spare assets, you can earn interest by lending. Platforms like Aave and Compound are well-known DeFi lending protocols that use code to ensure lenders get paid back and borrowers remain collateralized. If the value of a borrower’s collateral falls too low, the smart contract can even liquidate it (sell it off) to repay the lender, all according to pre-set rules.

Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value. Most commonly, they are pegged 1:1 to a major currency like the US dollar. Think of a stablecoin as a “crypto dollar” – for example, USD Coin (USDC) aims to always be worth \$1.00. Some stablecoins achieve this stability by being backed by reserves (traditional dollars or assets in a bank), and others are backed by crypto collateral or maintained through algorithms. Stablecoins are crucial in DeFi because they provide a relatively steady asset to trade or earn interest on, protecting users from the extreme volatility of other cryptocurrencies. In short, stablecoins act as the digital cash of the DeFi world, allowing people to price things in dollars (or other stable units) on the blockchain.

Yield Farming

Yield farming is a strategy where users move their crypto assets through various DeFi platforms to chase the best returns (or “yields”). In DeFi, many projects reward users for providing liquidity or staking tokens by giving out interest or new tokens. Yield farmers continuously look for where they can “plant” their crypto to earn the highest reward, often hopping between platforms or pools when better opportunities arise.

The term “farming” is used because it’s like planting seeds (your assets) in different fields (DeFi protocols) and trying to harvest the most crop (yield). For example, a user might provide liquidity to a DEX’s token pool and earn a portion of trading fees plus bonus tokens. Later, they might move those funds to a lending protocol if it starts offering higher interest. Yield farming can be very lucrative during boom times, but it is also risky and complex. Rapidly shifting funds between projects can backfire if a project turns out to be insecure or if prices move suddenly. It’s an advanced pursuit in DeFi, often compared to chasing high-interest rates by moving money between banks – except the “banks” here are decentralized apps, and the risks are higher.

Derivatives & Insurance

DeFi isn’t limited to basic trading and lending – it’s also building more advanced financial instruments. Derivatives in DeFi are contracts that derive value from an underlying asset or outcome. For instance, a DeFi derivative might let traders speculate on the future price of a cryptocurrency or on an index of multiple tokens, without holding the actual assets. These are similar to futures or options in traditional finance, but they run on smart contracts. Platforms like Synthetix allow creation of “synthetic” assets that track real-world prices (like gold or stock indices) in token form.

Meanwhile, decentralized insurance protocols aim to offer protection against risks in the crypto world. Users can pool funds to insure against specific events – for example, covering losses if a major smart contract is hacked or if a stablecoin collapses in value. If the bad event happens, the insurance fund pays out to those affected; if not, the insurers (the people who put in funds) earn premiums. It’s akin to a community insurance pool governed by code. An example is Nexus Mutual, which lets people collectively insure against things like exchange hacks or DeFi protocol failures. Together, derivatives and insurance expand the DeFi toolkit, providing more ways to hedge (offset risk) or safeguard value, much like their counterparts in traditional finance but without centralized companies running the show.

Benefits & Risks of DeFi

While DeFi brings exciting opportunities and greater freedom to finance, it also carries significant risks. It’s important to understand both the upsides and the downsides:

Benefits of DeFi

- Open and inclusive access: DeFi platforms are open to everyone with internet access, regardless of location or background. This inclusivity means people who can’t get traditional bank accounts can still use financial services. DeFi is also global and operates 24/7, so you aren’t limited by banking hours or borders.

- No intermediaries & lower costs: By removing middlemen (like banks, brokers, or payment processors), DeFi can eliminate many fees and delays. Transactions often settle faster, and users retain more control over their money. You don’t have to trust a company to hold or transfer your funds – the transactions are handled by transparent code.

- New financial opportunities: DeFi enables creative ways to put your assets to work. For example, you can earn interest on crypto holdings, provide liquidity to earn fees, or invest in new token projects. These opportunities, like yield farming or token staking, aren’t available in traditional banking. DeFi’s flexibility encourages innovation and competition, which can benefit users (through better rates or new services).

- Transparency and community control: Most DeFi protocols publish their smart-contract code, and all transactions are recorded on public blockchains. This transparency allows anyone to audit how a platform works. Many projects are also governed by their communities through tokens (a form of voting power for decisions), aiming for a more democratic financial system where users have a say in changes.

Risks of DeFi

- No safety nets or insurance: Unlike money in a bank, funds in DeFi aren’t FDIC-insured or protected by government guarantees. If a platform fails or you lose money due to a glitch or hack, there’s usually no way to recover it. You’re fully responsible for your funds, and transactions are generally irreversible – if you send crypto to the wrong address or a smart contract malfunctions, you can’t simply call a bank to fix it.

- Smart contract vulnerabilities: DeFi relies on software, and software can have bugs. Hackers have exploited flaws in smart contracts to steal funds from DeFi platforms. Even a tiny mistake in the code can lead to millions of dollars lost. There’s also the risk of “rug pulls” – scams where developers launch a DeFi project, attract investments, then suddenly disappear with the money. Using DeFi means accepting these technical and security risks.

- Market volatility: Cryptocurrencies are known for wild price swings, and DeFi is often tied to these volatile assets. If the market value of the token you’ve borrowed or lent changes rapidly, you could be liquidated (forced to sell collateral) or face large losses. Even stablecoins, while designed to hold value, can occasionally lose their peg (for example, a \$1.00 stablecoin dropping below \$1), causing instability. This unpredictability can make participating in DeFi financially risky.

- Complexity and user error: Using DeFi typically requires more technical knowledge than using a bank’s website or app. Users must manage their own crypto wallets and private keys, navigate unfamiliar interfaces, and understand the rules of each protocol. A simple mistake – like losing a password, or sending funds to an incorrect address – can mean permanent loss. There’s no customer support hotline in most DeFi services, so users have to be extra careful and self-reliant.

Risks & Important Considerations

- Irreversible transactions – no do-overs: In DeFi, “code is law.” Once a transaction is executed on the blockchain, it generally cannot be undone. If a flaw in a smart contract is exploited or you make a mistake, the outcome (loss of funds, incorrect transfer, etc.) is usually permanent.

- No government protections: Funds in DeFi have no government or regulatory insurance. There’s no bank or authority to reimburse you for losses. You’re operating in a largely unregulated environment, so if a platform collapses or is hacked, users bear the full brunt of the loss.

- Beware of scams and “rug pulls”: The DeFi space, being open and relatively anonymous, is a breeding ground for fraudulent projects. Some developers may create hype around a new token or platform and then vanish with investors’ money. Always be skeptical of too-good-to-be-true returns and unverified projects.

- No dispute resolution or customer support: There is typically no help desk in DeFi. If something goes wrong – say a smart contract behaves unexpectedly or you fall victim to fraud – there isn’t a dedicated support team or legal avenue to resolve it. You can’t appeal to a bank or court to reverse a blockchain transaction; responsibility lies with the user.

- Educational content – not financial advice: The examples and services mentioned in this module are to explain how DeFi works, not to endorse any specific platform or encourage you to invest. Always do your own research before participating in any financial product.

- Use caution and start small: DeFi is a cutting-edge arena with high risks. If you decide to explore, consider sticking to well-established, audited projects, and maybe try with a small amount first. Protect your wallet keys and personal data, and never invest more than you can afford to lose. In short, stay informed and be careful.

The following links are provided for educational and informational purposes only. Literacy & Innovation in Financial Technology Alliance (LIFT) does not endorse any of the organizations, products, services, or opinions presented on these external sites. LIFT is not responsible for the accuracy or content of external sites. We encourage you to conduct your own research.

Further Reading & Sources

- Britannica – What Is Decentralized Finance?

- Investopedia – What Is Decentralized Finance (DeFi) and How Does It Work?

- Fidelity – What Is DeFi?

- Gemini – Decentralized Finance Trends & Solutions

- QuickNode – Introduction to DeFi

- Ethereum.org – Decentralized Finance (DeFi)

- Whiteboard Crypto – What is DeFi? (video)

Disclaimer: This article is for educational purposes only and does not constitute financial advice.