Key Takeaways

- Custodial vs. Self-Custodial: Custodial wallets let a third party hold your crypto. Self-custodial wallets give you the keys and full control.

- Private Keys & Seed Phrases Matter: These secrets unlock your funds. Lose them and you lose access; share them and someone else gains control.

- Security Is Habit-Based: Use strong passwords, two-factor authentication, offline backups, and beware of phishing.

- No Safety Net: Crypto transactions are usually irreversible. Take precautions before you act.

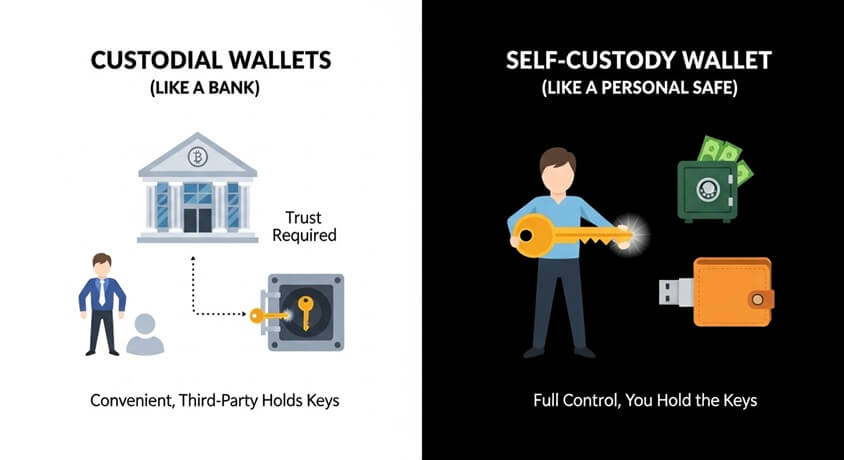

Custodial vs. Self-Custodial Wallets

Custodial wallets store your crypto on a platform’s servers. The platform controls the private keys, and you trust it to stay solvent and secure.

Self-custodial wallets put you in charge. You hold the keys on a local app or hardware device. The phrase “not your keys, not your coins” sums it up.

Analogy: A custodial wallet is like a bank vault holding your cash. A self-custodial wallet is a home safe where you keep the cash and the key.

Private Keys, Seed Phrases, and Addresses

Private key = secret password. Whoever knows it can spend your crypto.

Seed phrase = backup. A 12–24-word list that can recreate your private keys. Keep it offline.

Address = public account number. Share it freely to receive funds.

Analogy: Your address is the mailbox location, the private key is the mailbox key, and the seed phrase is a master copy of that key.

Basic Security Best Practices

- Never share your seed phrase or keys.

- Use strong passwords and enable 2-factor authentication (2FA).

- Store backups offline (paper or metal) in a safe place.

- Beware of phishing links and fake support requests.

- Treat your crypto like cash or jewelry—protect it from theft and prying eyes.

Scam scenario: You get an email claiming to be your wallet provider asking for your seed phrase. Stop. It’s a scam. No legitimate service needs your private secrets.

Risks & Important Considerations

- Total responsibility: Lose your keys and your funds are gone—no reset button.

- Custodial risk: Exchanges can be hacked or freeze withdrawals. You hold only an IOU.

- Scams & malware: Phishing websites, clipboard hijackers, and impersonators target crypto users.

- Education, not endorsement: Examples here (Ledger, MetaMask, etc.) are for context only—do your own research.

The following links are provided for educational and informational purposes only. Literacy & Innovation in Financial Technology Alliance (LIFT) does not endorse any of the organizations, products, services, or opinions presented on these external sites. LIFT is not responsible for the accuracy or content of external sites. We encourage you to conduct your own research.